![Build a Crypto-Fit Product [CULD Framework]](/content/images/2024/05/Cover-1.png)

Blockchain is a significant social and technological change that transforms our mindset about how we interact in the digital world, capture value, and collaborate.

Thanks to its flexible and open design space, it unlocks numerous opportunities for designers and developers to build protocols that shape the next generation of the internet.

However, due to its novelty, there is not a comprehensive framework that defines a structure for building an efficient business in crypto. That's why we decided to write this article.

CULD Framework

We have defined a framework called CULD, which stands for Community, Utility, Liquidity, and Distribution. This framework outlines the key elements you need to consider for building a successful crypto project.

Note: This framework is not set in stone and is based on our understanding of and experience with the industry. It evolves as new insights are gained and industry dynamics change. However, it provides a basis and solid foundational perspective.

Loyal [Community]

Community is the heart of any crypto project. The key distinction between web3 and web2 projects lies in breaking down communication barriers. In web3, the structure shifts from hierarchical to flat, fostering more inclusive collaboration.

This seamless communication makes everyone feel included in the project, fostering loyalty. Generally, in any crypto project, community loyalty is rooted in two types of ownership:

- Financial: Distributing tokens among users, giving them ownership of the project (DAO).

- Social: Encouraging friendly and open communication with users, creating a space for them to share their thoughts.

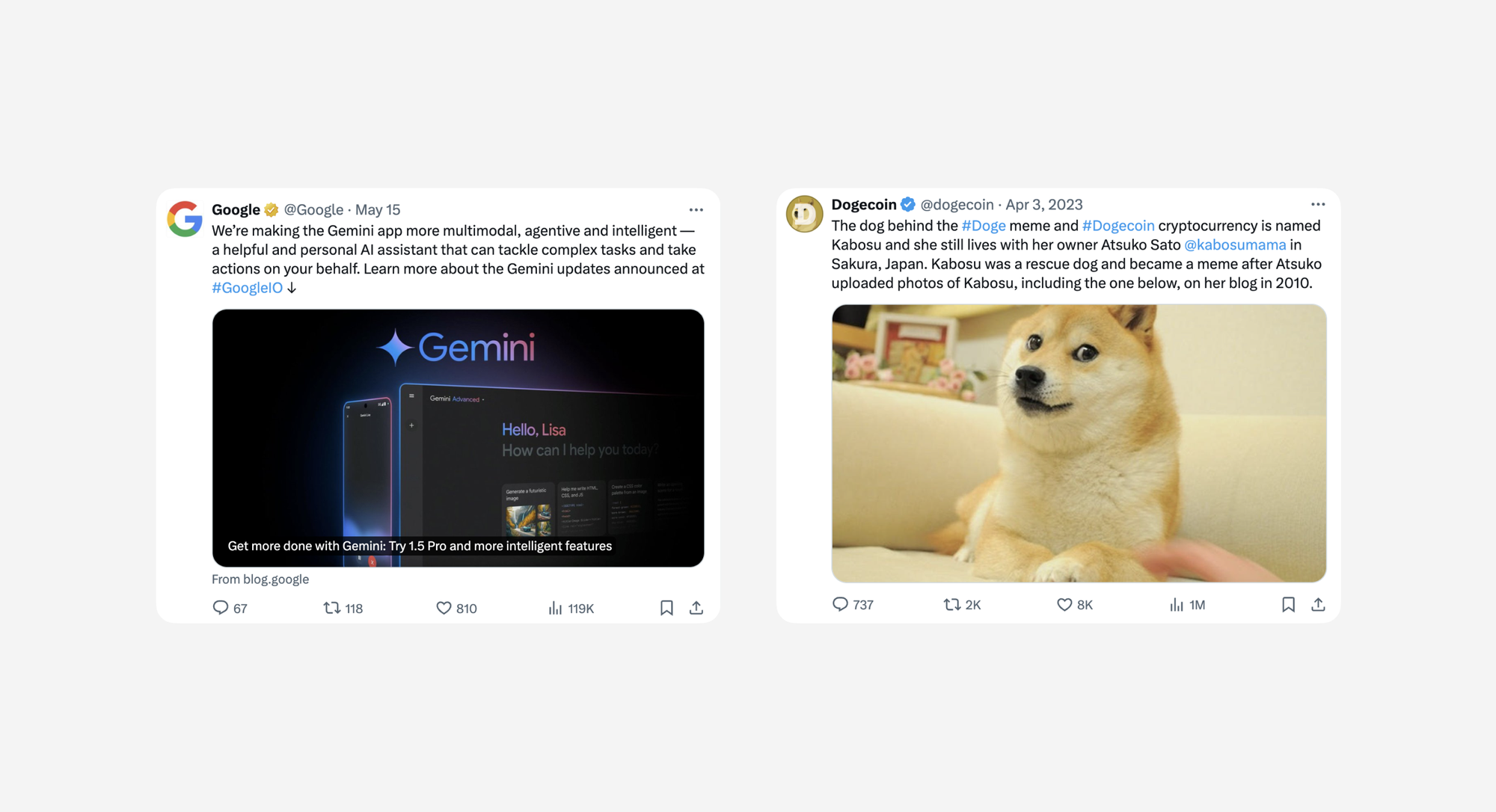

To see this in action, let us compare the number of likes and comments Google received when introducing an innovative product “Gemini” to the number of Dogecoin gets from a simple tweet.

The reason for this difference is that users are merely consumers in the first case, whereas, in the second, they are owners. This is the endowment effect, which suggests that when users own something, they overvalue its worth.

Product [Utility]

The most crucial element in creating a sustainable and long-term business in crypto is a product with a real use case. Many people think that tokens can replace products, but tokens are just digital primitives that help you achieve product-market fit more easily.

It is possible for a product to survive without a token, but the reverse is not true. for example, Opensea, an NFT market, maintains a significant market share even without tokens because of its exceptional features.

You might say that meme coins are an exception, but when they are big enough, they start designing tools and products around their token to build a sustainable economy. For example, Bera community launched its own blockchain network to create more value for their tokens.

Token [Liquidity]

If your token does not have sufficient liquidity, it will not matter at all. A token can only be considered a strong coordination tool if it can be easily liquidated. If speculation-seeking retailers can't easily buy or sell your token, they won't be able to help you scale the project.

To enhance your token’s liquidity, you have two main options:

- Listing on centralized exchanges (CEXs): This is not an ideal solution for small and early-stage projects. Centralized exchanges like Coinbase and Binance, which can significantly boost the organic liquidity of your token, require rigorous criteria and high listing fees.

- Listing on decentralized exchanges (DEXs): This is a better fit for projects in their early stages. Thanks to the AMM mechanism, led by Uniswap, any project at any scale can create liquidity pools for their token with just a few clicks and expose it to millions of retail traders.

While AMM DEXs offer accessible infrastructure to streamline token liquidizing, having incentivized liquidity providers is crucial. They help add liquidity to your pool, facilitating large, slippage-free trades. This becomes especially vital when the trading volume of your token is insufficient to attract liquidity providers with trade fees.

You can create this incentive by offering inflationary rewards (free tokens) which is suitable for the short term. However, in the long run, excessive printing and distribution of tokens will devalue the token and backfire.

A better and more sustainable way is to distribute a significant portion of the protocol's revenue to LPs. For this, you need a product with real utility and actual users. However, due to lack of real token utility, many in the crypto space stick to the first model because of this requirement.

Some revenue-generating products distribute earnings only among token holders. However, in our view, alongside token holders, LPs should also be rewarded because they bear more risk by providing liquidity (e.g., impermanent loss) and adding more value to the project's ecosystem.

Market [Distribution]

The crypto space is a crowded field with thousands of projects seeking attention from retail users. In such an environment, single-handed marketing efforts can be extremely challenging, which is why you need help from the community.

Most trending crypto projects, especially meme coins, achieve success through built-in distribution programs. These often take the form of referral schemes, such as "Invite your friend and earn rewards.”

For example, GMX, a perpetual futures exchange, launched a referral program at its inception that significantly contributed to its growth. The program rewarded the referrer with a portion of the trading fees from invited users and gave the invitees a discount on trading fees.

This incentivized everyone to both invite others and to be invited. Many influencers saw this as a potential revenue stream and included their invite code in their Twitter bios, encouraging their followers to join the exchange through their links.

However, you can only motivate influencers to promote your product if it has a real use case and clear innovation. Additionally, by making your referral program on-chain, you can add transparency sauce, increasing participants' motivation to engage.

Conclusion

Ultimately, embracing the principles outlined in the CULD framework can empower crypto projects to thrive in a competitive and ever-changing market.

Building a loyal community, ensuring product utility, maintaining token liquidity, and leveraging smart distribution strategies are essential for long-term success.

As the blockchain industry matures, adhering to these guidelines will help developers and innovators unlock new opportunities and redefine the future of digital interactions.